CBDT exempts TDS for IFSC Units

The provisions will come into force on 1-4-2024.

The provisions will come into force on 1-4-2024.

The High Court cautioned that if consideration of such artificial deductions is allowed, then in every petition under Section 125 of CrPC there would be tendency by the husband to show lesser salary with an intention to mislead the Courts so as to avoid giving maintenance.

“Once it is concluded that a live telecast will not fall within the ambit of the expression “work”, it will be wholly erroneous to hold that the income derived by the assessee in respect of “live feed” will fall within clause (v) of Explanation 2 to Section 9(1)(vi) of the Income Tax Act, 1961.”

“Earlier, the Bench had verbally observed that central assessment may be necessary if there were cross transactions between individuals.”

Corporate Laws — Company Law — Winding up and Liquidation — Overriding preferential payments: Dues towards customs duty i.e. government dues falling

“The Appellate Authority had allowed the appeal in the case of a different assessee, who had been carrying on the very same work of solid waste disposal in the very same Municipality.”

The case of the petitioner is quite elementary, and we are constrained to observe the complete apathy and negligent approach of the assessing officer concerned in discharging his duties, by the provisions of the Income Tax Act, 1961.

As per an additional affidavit submitted, the CBDT has provided the way, in the past and future, pending appeals are to be dealt with and disposed of expeditiously as well as a road map to dispose of pending appeals.

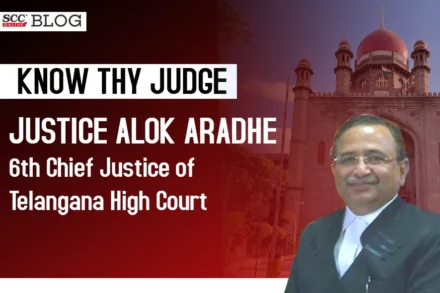

Justice Alok Aradhe was sworn in as Chief Justice of Telangana High Court on 23-07-2023 by the Governor Tamilisai Soundararajan. He succeeded Justice Ujjal Bhuyan who has been elevated as a Judge in the Supreme Court of India. Justice Aradhe has formerly served as Judge in Karnataka, Jammu and Kashmir and Madhya Pradesh High Courts.

Section 127 of IT Act to the extent it permits transfer from one Assessing Officer under a Principal Commissioner of Income Tax to another Assessing Officer under another Principal Commissioner of Income Tax who are holding non-concurrent charges remains untouched and continues to apply in its pristine form.

On 21-6-2023, the Ministry of Finance notified the Income-tax (Tenth Amendment) Rules, 2023 to amend the Income-tax Rules, 1962. Key Points: Rule

It is a well-accepted principal of tax jurisprudence that the Assessing Officer cannot sit on the armchair of a businessman assessee to replace his business strategy by his own whims and fancies

On 29-5-2023, the Ministry of Finance notified the e-Appeals Scheme, 2023 to reduce pendency of appeals related to Tax Deducted at Source

ITAT said that the entire addition has been made by the AO as well as CIT based on guess work and estimation based on some alleged information received from Sales Tax Department of Maharashtra and from DGIT that “the assessee has taken bogus purchase bills without having taken any delivery of the goods”, without applying their mind.

The Revenue had submitted that the Assessing Officer is competent to consider all the material that is available on record, including that found during the search, and make an assessment of ‘total income’. While some of the High Courts agreed with the said proposition, some disagreed. The Supreme Court was, hence, called upon to resolve the conundrum.

The amendment in Section 153-C of the Income Tax, 1961 was brought and the words “belongs or belong to” were substituted by the words “pertains or pertain to” after a ruling by Delhi High Court in Pepsico India Holdings Private Limited v. ACIT, 2014 SCC OnLine Del 4155.

It is a trite law that the reasons, as recorded for reopening the reassessment, are to be examined on a standalone basis to determine the validity of proceedings under section 147 IT Act.

The Delhi High Court observed that there was an unexplained substantial delay in issuing the impugned Show Cause Notice dated 09-11-2017 and thus, is inexcusable in the eyes of law

This roundup contains many interesting rulings including the Shiv Sena Party Name and Symbol Dispute, Negligence committed by doctors and Compensation therein, Amendment to Section 178(6) of the Income Tax Act, Initiation of the Corporate Insolvency Resolution Process and more.

A clarificatory press release dated 1-03-2013 issued by the Finance Ministry pursuant to the 2013 amendment makes it clear that a Tax Residency Certificate is to be accepted and tax authorities cannot go behind it. Further, based on repeated assurances to foreign investors by way of CBDT Circulars as well as press releases and legislative amendments and decisions of the Courts, the revenue cannot go behind TRC.