IBC

Delhi High Court dismisses PIL filed seeking directions to draft and implement a comprehensive scheme to address the grievances of home buyers availing home loans

The PIL seeks formulation and implementation of a scheme that conclusively addresses the grievances of other home buyers who may not have the capacity to approach courts/forums to seek redressal against builders.

Initiation of IBC proceedings does not absolve Company Directors/Signatories of criminal liability under Section 138 NI Act: SC

The Supreme Court observed that the scope of nature of proceedings under the two Acts are quite different and would not intercede each other.

Swiss Challenge and Insolvency and Bankruptcy Code – Does the Shoe Fit The Size?

by Swarnendu Chatterjee†, Anwesha Pal†† and Megha Saha†††

Cite as: 2023 SCC OnLine Blog Exp 22

In view of moratorium declared by NCLT, all the proceedings in Court, Tribunal cannot continue on account of Amendment to S. 178(6) IT Act: ITAT

ITAT reiterated that IBC has overriding effect on all the acts including Income Tax Act (‘IT Act’) which has been specifically provided under Section 178(6) of the IT Act as amended w.e.f. 01-11-2016.

[IBC] Statutory authorities chose not to submit their proof of claim; Delhi High Court quashes show cause issued by Directorate of Revenue Intelligence

In the instant case, the Directorate of Revenue Intelligence neither submitted proof of claim nor responded to a specific communication via an e-mail addressed to Senior Intelligence Officer. This is a case where despite knowledge, the statutory authorities chose not to submit their proof of claim.

PF and gratuity dues not part of liquidation estate; cannot be recovered under Section 53 of IBC which provides for waterfall mechanism: Supreme Court

Supreme Court upheld the NCLT order that the provident fund, pension fund and gratuity fund are not part of the liquidation estate, for distribution under Section 53 of the IBC and the same has to be paid to the employees under the stated heads.

NCLAT | IBC overrides Limitation Act; Delay beyond period of 45 days cannot be condoned

While adjudicating an appeal file with a delay of 55 days, the Tribunal held that S. 238 IBC overrides S. 12 of the Limitation Act, 1963 and therefore this Tribunal does not have power to condone a delay beyond a period of 45 days.

Supreme Court January 2023| Note Ban; Free Speech; Euthanasia; Delhi versus Centre; Haldwani Eviction, Dissents, Did You Know Facts, & more

This roundup revisits the analyses of Supreme Court’s judgments/orders on constitutionality of Demonetisation; Freedom of Speech of Ministers; Guidelines to withhold life support of a terminally ill patients; Tussle between Delhi Government and Centre, and more. It also covers reports on Justice SA Nazeer’s retirement; the career trajectory & important decision of Justice CT Ravikumar; Explainers on important law points; five ‘Did You Know’ facts; Cases Reported in SCC Weekly in the month of January; and a throwback from SCC Archives.

[S.156(3) CrPC] Bombay High Court| Affidavit not in compliance with Chapter VII of the Criminal Manual is deemed non-compliance with the mandatory requirement of filing an affidavit

There should be no scope for the declarant to escape on the technical grounds from responsibility attached to the statement made by him in the affidavit. Unless those compliances, referred to in paragraphs 5 and 8 of chapter VII of the Criminal Manual are complied with, it will be difficult to hold the person making a declaration on oath responsible for the statement made on an oath.

Deduction of TDS and deposit in Form 16-A under Section 194-A of Income Tax Act proves the deduction was TDS relating to ‘Interest other than interest on securities’: NCLAT observes

In the instant matter an appeal was preferred against the order of NCLT admitting S. 7 IBC application or repayment of financial debt. Upholding the order of the NCLT, the Tribunal held that even if there is no proof of loan agreement other materials on record can prove the financial debt.

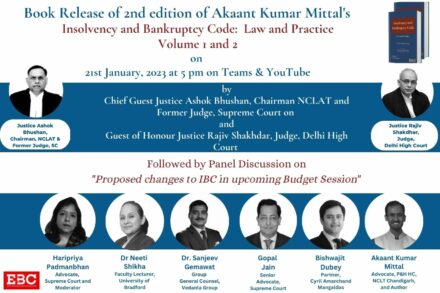

Resolution Professionals should be given enough time to verify claims: Justice Bhushan, Chairman, NCLAT

Eastern Book Company released the second edition of the landmark book on Insolvency and Bankruptcy Law – titled Insolvency and Bankruptcy Code:

EBC announces launch of 2nd edition of Akaant Kumar Mittal’s Insolvency and Bankruptcy Code: Law and Practice: Registration Link Inside!

The second edition of Akaant Kumar Mittal’s Insolvency and Bankruptcy Code: Law and Practice promises to be even more comprehensive than before.

Approval of a Resolution Plan does not ipso facto discharge a Personal Guarantor of a Corporate Debtor of his liabilities under Contract of Guarantee; Allahabad High Court reiterates

Allahabad High Court said that challenge to demand notice for electricity dues, issued jointly in name of Directors of the insolvent company cannot be sustained on the ground that liabilities of guarantor stood automatically discharged on acceptance of Resolution Plan.

IBC| “No law would compel a person to do the impossible”, Supreme Court upholds validity of the moratorium period which debarred the appellant from making settlement payment.

The Supreme Court stated that it was neither a case where the appellant did not make any application within the stipulated time under the 2019 Scheme nor where the appellant deliberately did not deposit the settlement amount.

2022: The year of 1263 judgments; 3 CJIs; and important firsts| An all inclusive Supreme Court roundup

With 1263 judgments delivered; three Chief Justices of India taking turns to lead the judiciary; a number of judges retiring and a

NCLAT | No provision for making any modification in the resolution plan; Adjudicating Authority can either approve or reject it

National Company Law Appellate Tribunal held that there is no provision in Insolvency Bankruptcy Code, 2016 for alteration or modification in the resolution plan by the Adjudicating Authority

NCLAT | Application under Section 7 IBC relating to the interest component due even if principal amount is not due, held maintainable

National Company Law Appellate Tribunal | Upholding the maintainability of an application filed under S. 7 IBC, a bench comprising of Rakesh

Claims of various stakeholders to be considered by Resolution Professional in accordance with law; NCLT, Chandigarh emphasizes

That various stakeholders are to be considered by the Resolution Professional under the relevant provisions of IBC andin accordance with law, and the same should be placed before the CoC for approval. Thus, the resolution plan was sent back for approval by the Committee of Creditors.

The Clean Slate Theory – IBC’s Version of Hermione’s Obliviate Spell

by Akaant Kumar Mittal†

Cite as: 2022 SCC OnLine Blog Exp 83